Connect with Me:

Kalpa Fintech, a financial firm promoted by Ramachandran M P, Certified Financial Planner from FPSB Institute, USA, a MBA Graduate, Life member of IIMM, Mumbai.

Registered Mutual Fund Distributor – working based on AMFI guidelines and SEBI regulations.

Practicing as a Personnel Finance Professional and a Proud member of BNI, a world renowned organisation for business Networking.

Decades of Managerial, Commercial and Foreign Trade experience in Premier Organisations – KELTRON and Asianet Satellite Commutations Ltd. Retired as Vice President from Asianet.

Keen to share knowledge to needful people from every walk of life for achieving their financial goals

Unique Experience

- What sets us apart is that we are completely independent, offering a unique approach to Financial Planning and Investment Management in Mutual Fund.

- Protection of customer fund is of supreme importance and it needs to be implemented with exceptional knowledge and proper planning.

- Tried and tested Financial Planning process of Risk Profiling, Goal Planning, Portfolio Structuring and Portfolio Tracking to create wealth and meet

clients financial goals, well within their comfort levels. - The level of loyalty we exhibit directly translates to how we treat every client. At the end of the day, we desire deep relationships built on trust and solid financial advice. We consider our clients as our family members.

- For everyone who is serious about accumulating wealth and planning for a fulfilling retirement, we will help them make those goals a reality through the combination of our knowledge, advice and selection of right portfolio of Schemes in relation to mutual fund Investment and financial education through Investment Awareness Program.

- Our motto is to seek and build a long-term relationship with our clients.

Financial Planning

Comprehensive Financial Planning Process

- Making relationship with the client,

- Gathering relevant financial information,

- Discussing and setting life goals,

- Examining your current financial status

- Making strategy and plan for you to meet your goals given your current situation and implementing them,

- Monitoring and making timely changes to the PLAN.

Relationship and Commitment

- A comprehensive financial plan calls for more time commitment on the part of both the investor and the financial planner.

- The comprehensive financial plan captures the estimated inflows from various sources, and estimated outflows for various financial goals,

including post-retirement living expenses. The plan can go decades into the future.

Benefits of Comprehensive financial planning

- The financial planner is in a position to advice investors on all the financial aspects of their life.

- Financial Planning provides direction and meaning to your whole financial decisions. It allows you to understand how each financial

decision you make affects other areas of your finances. - Financial planners can also help investors in planning for contingencies. This could be through advice on insurance products, Fixed deposits etc.

- Buying a particular investment product or extending home loan tenure may be beneficial to a client. By viewing each financial decision as part of the whole, can consider its short and long-term effects on their life goals. You can also adapt more easily to life changes and feel more secure that your goals are on track.

Goal based Financial Plan

- Everyone has needs and aspirations. Most needs and aspirations call for a financial commitment.

- A father wants his son to become a doctor. This is an aspiration. In order to realize this, formal education expenses, coaching class expenses, hostel expenses and various other expenses need to be incurred over a number of

years. - Providing and committing the estimated financial expenses towards achieving this Goal become financial goal.

- Similarly, there are various financial goals for every individual based on his aspirations. Such example of financial goals are

- Buying a Car

- Owning a Home

- Holidaying in tourist location

- Marriage of Children

- Retirement Planning

- Financial goals must be S.M.A.R.T.

- It should be Specific, Measurable, Achievable, Realistic and Time bound.

- Once the Goals are defined it should be prioritised and select the critical and achievable goals within the constraints of availability of resources.

- Every individual has to make financial plan for achieving their goals.

- Proper advice and guidance are required for achieving the financial goals.

- Fulfilling the financial goal sets people on the path towards realizing their needs and aspirations.

- People experience happiness, when their needs and aspirations are realized within an identified time frame

Retirement Planning

- Retirement planning is the most important goal for every one’s life for leading a financially peaceful life.

- Even if retirement is still many years down the road, it’s never too early to start saving. If you are nearing retirement or already retired, still it is better late than never.

- We can help you understand your needs and create a financial plan for whatever

life may present during your golden years of retirement. - Investments in various types of instruments are required for achieving this and the portfolio of investments at the right mix should be selected from various options as below.

Investment Avenues

Investment Concerns

Major Investment concerns for every individual while thinking of investments are Inflation, Tax and Risk

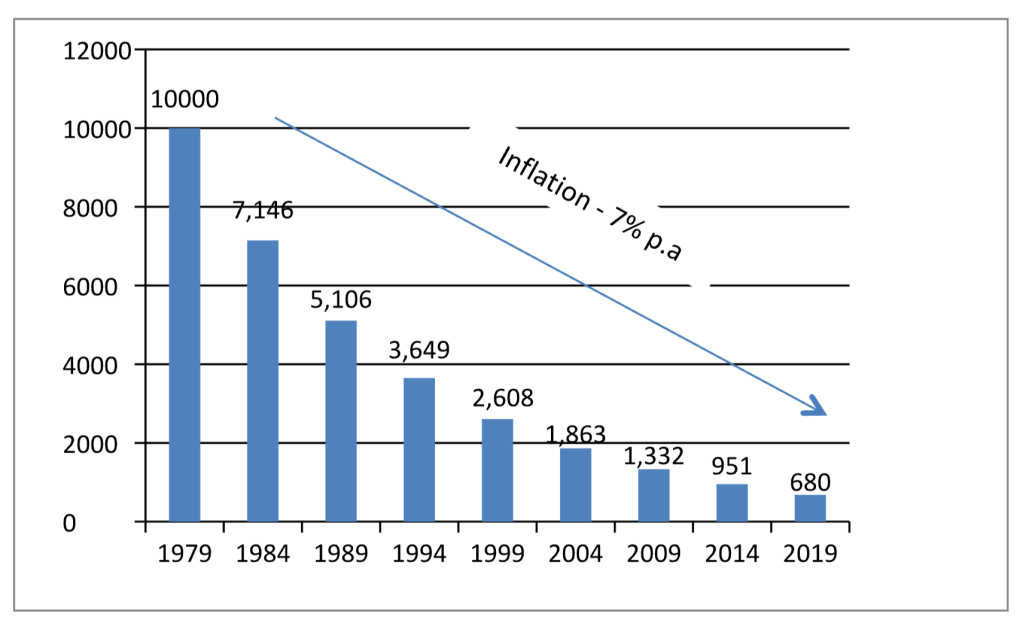

Impact of Inflation

- Inflation is the long term rise in the prices of goods and services caused by

the devaluation of Money. - The average inflation per year for last 40 years is around 7%. It means the value of Rs. 10,000/- in 1980 is worth Rs. 680/- now as indicated below.

- In other words, due to inflation, the future value of rupee will be reduced considerably and the goods you can buy today cannot be purchased few years down the lane for the same amount.

- For example at 7% inflation you require Rs 76123/- thirty years from now, for buying goods which can be purchased at Rs 10000/- today. Money requirement for various years are as below.

| Years | Future money requirement |

| 5 | 14,026 |

| 10 | 19,672 |

| 15 | 27,590 |

| 20 | 38,697 |

| 25 | 54,274 |

| 30 | 76,123 |

- You cannot avoid inflation but overcome it buy making investment to beat the inflation so that your investment is sufficient to buy the goods and services at a later date.

Tax Implications

- Every income is subject to tax as per the prevailing tax laws and tax is to be paid to the government based on your income.

- Currently there are two types of Tax regime – 1. New Tax regime and 2. Old Tax Regime making more complex for a common man to select the suitable scheme.

- Tax planning is therefore one of the important aspects of investment.

Risk

- Everything in life is uncertain. No one can predict the future perfectly and the people seek avenues to cover the risk.

- Insurance covers the risk on life. Medical Insurance covers the risk on health. Vehicle insurance covers the risk on damages or accidents to the vehicle or people.

- Everyone should take a TERM Insurance for their life and a Health Insurance for suitable value. The life and health is more important than a vehicle.

- Inflation and Liquidity are the major risk associated with investments. Higher the return higher the risk and every investor is in a dilemma where to invest and how much to invest.

- Selection of portfolio is the insurance to cover the uncertainty on return, inflation and Liquidity. A registered MFD can guide you for selecting your portfolio of investments in Mutual Fund.

Investment Options

Each individual’s requirements are different and vary from time to time and therefore will have to take proper decisions in investment. There are various types of investment for day to day needs.

Fixed Income Securities

- Savings Bank Account, Fixed Deposit and Recurring Deposits in Banks and post offices are basic investments considered by many.. The return on investments may not cover even the inflation, however one of the most safe investment options who cannot take any amount of Risk.

- Investments in PPF, NSC, National pension scheme etc. are long term investments options and also eligible for income tax benefit up to 1.5 Lakhs per year and an additional Rs. 50000 in NPS. This may change every year.

Investments in Commodities

Gold, Silver, Petroleum Products and similar goods are good investments for protecting the capital during uncertain times. Liquidity and transaction are problems being faced in Physical commodity apart from the quantity legally allowed for holding. God Bonds are better options now.

Investment in Real Estate

Real Estate is another option and the amount required for investment will be very high and the liquidity is the critical problems.

Investments in Security Markets

- Shares and Bonds of listed Public ltd. Companies and other securities are traded in the security markets. The investors can invest their money during initial public offering of these companies or can be purchased and sold through stock exchanges.

- The return is very high in investments in shares and many people made a fortune in investing in them. However this is high risk investments and huge number of investors had lost their money by investing in them. Seasoned and highly knowledgeable traders make huge money and novice lose their money.

- BSE Sensex is widely talked index of stock market and is a measure of 30 highly traded stock of Bombay stock exchange. In 1979 the Sensex index was 100 and Jan 2020 it was 42000 and in July 37000. The growth of SENSEX is represented below. No other investment has given such a high return. But the Risk in investment is highest among these asset classe.

Mutual Funds

What is a Mutual Fund?

- A Mutual Fund is a vehicle to invest in all these 4 asset Classes – Fixed Income Securities, Commodities, Real Estate and Equity Shares/ Securities.

- A Mutual Fund is registered as a TRUST which pools money from many investors and invest in various securities.

- The money collected from investors is invested in capital market instruments such as shares, debentures, Government securities, Gold, Real Estate etc. by professionals as per the investment objective of each scheme.

- The income earned from these investments and the capital appreciation realized is shared by its unit holders in proportion to the number of units owned by them.

Regulations

- All the mutual funds are regulated by SEBI and they function within the provisions of strict regulation designed to protect the interests of the investor.

- AMFI is continuously making awareness campaigns and also register Mutual Fund Distributors and Registered Investment Advisors for the benefit of investors and monitor their functioning to protect investor interest.

Types of Mutual Funds

- SEBI classified Mutual Funds in to various categories and the major ones are as below. All the fund houses are having Schemes in different category of investments as below.

| Liquid Funds | Invest in debt securities for a duration of 90 days |

| Debt Funds | Invest in debt securities for various durations depending upon the scheme. |

| Equity Funds | Invest in Equity shares and Securities of various category depending on the scheme. |

| Hybrid Funds | Combination of Share and Fixed Deposit at varying percentages depending on the scheme |

- There are different schemes under each category and thousands of schemes are available for all the Fund houses put together.

Mutual Fund Portfolio Selection

Hard earned money is being invested to create wealth and to satisfy his financial goals. What are the Tax implications of your investments? What is the impact of Inflation? How much return is expected from your investments?

- The attribute of good Investment is Liquidity, Tax saving, Risk Protection and High return.

- The Risk appetite of each investor is very important while selecting the portfolio. Higher the return higher the risk.

- The return should be able to cover the inflation and tax implications. Tax adjusted return to offset the inflation is the minimum expectation of any investor.

- An investor can select his investments to fulfill his aspirations based on the surplus amount he can invest.

- Investments can be made in suitable schemes depending risk profile and financial goals of the Investor.

- AN MFD can select the appropriate scheme as per need after assessing the profile of every client.

- We are registered with AMFI as MUTUAL FUND Distributor and empaneled with Mutual Fund Houses for distribution of their various Schemes to the prospective investors. We have no preference on any of the partners.

Advantages

- Debt Mutual funds schemes are schemes which provide stability more or less similar to fixed deposits or Bonds but with similar or higher return than FD along with better taxation benefits and also avoid concentrations risk.

- A Mutual Fund is one of the most suitable investments for the common man as it offers an opportunity to invest in a diversified professionally managed basket of securities at a relatively low cost.

- Can start investing small amounts as SIPs at fixed intervals or when they have fund available with them as lump sum.

- This also avoids the timing of when to buy and when to sell complexities of share market which require enormous knowledge and expertise.

- The investor can reap high returns of equity markets and reduce general risk associated with stocks.

- The investments decisions of mutual Funds are handled by highly qualified professions and the risk in investing directly in shares are avoided.

- An investor can invest in few stocks or bonds with the available surplus income whereas investing in mutual fund can spread its risk by investing in diversified portfolio of sound stocks or bonds across sectors.

- Mutual Funds also provide complete portfolio disclosure of the investments and also the proportion of investment in each asset type and clearly layout their investment strategy to the investor.

- Mutual Funds regularly provide investors Transparent information on the value of their investment.

- The units can be sold at any time to the mutual fund and the money will be credited within 2 days and provide high liquidity.

- Registered as Mutual Fund Distributors are mandated by SEBI to provide help to investors to select the right mutual Fund scheme to create wealth.

How to make Investments

KYC is the most important process to start an Investment in Mutual Fund or share market. The following documents are required for KYC.

- Copy of Pan card, cancelled cheque, Photo, Aadhar card, Mobile number, Email ID, Nominee details, Place of birth etc.

- Copy of Pass port and Foreign address proof are additionally required NRI Investors.

If KYC is not done earlier, this software can help you to complete the KYC online. We can also arrange KYC on providing the above documents.

Customer can register by login to the investment section or you can WhatsApp the required documents to us and we will register your account with the exchange. You will receive email from the exchange with your complete details filled in and you have to check, verify and approve the same and the account is created.

Now you are ready to start Investment in Mutual Fund and monitor your

investments through Mobile app being provided to you.

Mutual Fund investments are subject to market risk, read all scheme related documents carefully.

FAQs

How can I make an investment?

We are a registered mutual fund distributer. You can either contact us for a detailed discussion or you can click here to login and invest